We combine technical and commercial expertise, on the ground insight and extensive industry experience, to deliver consistent returns to investors through provision of growth capital to the US upstream oil and gas industry.

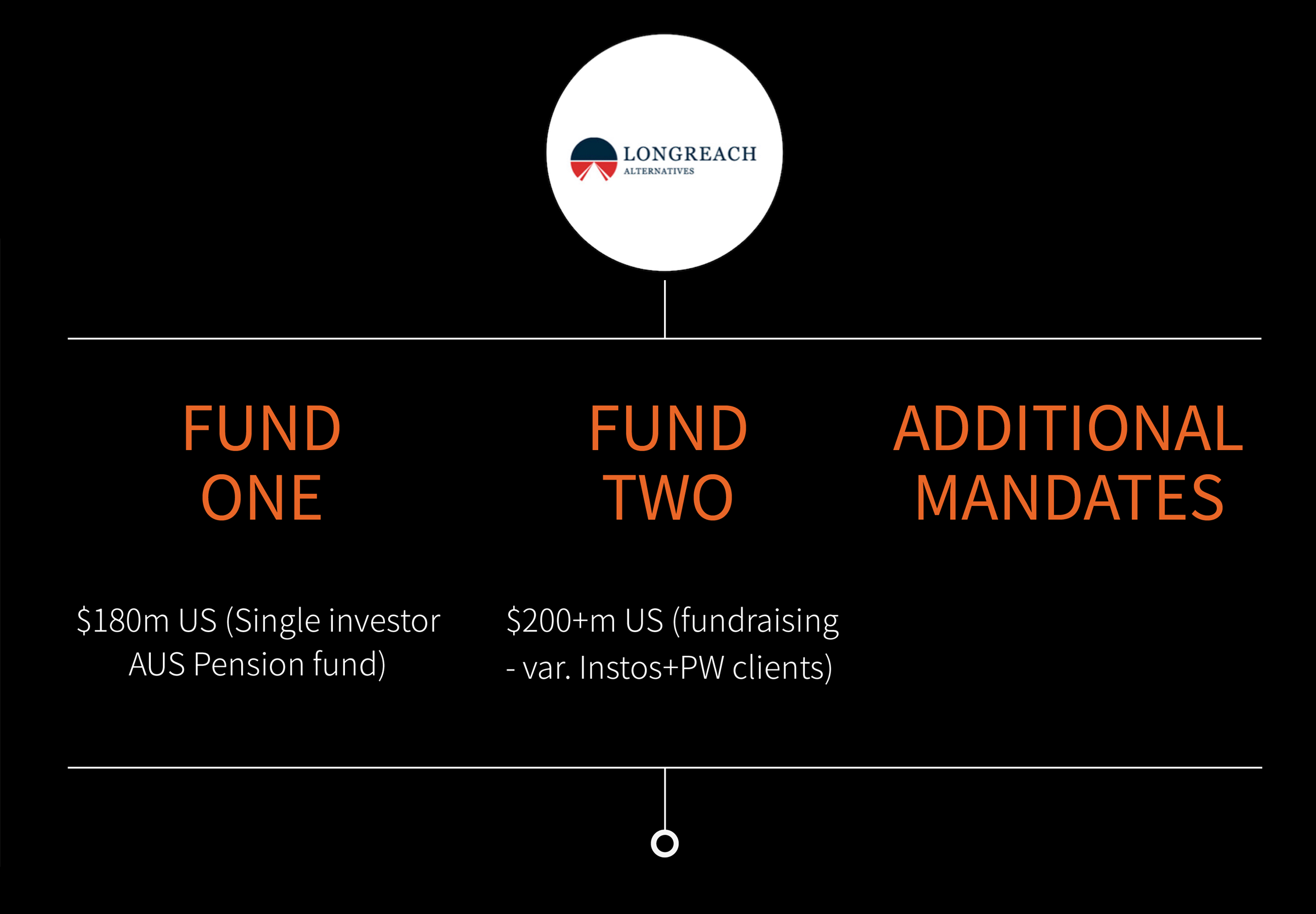

Giant Capital is a founding partner of Longreach Energy and is the investment manager of the Longreach Energy family of funds.

Our innovative and agile approach sees us invest directly in assets. Giant Capital’s funds acquire both oil and gas minerals and interests in development projects.

Drawing on our decades of experience and cutting‑edge in‑house technology, we specialise in identifying undervalued oil and gas assets that offer attractive returns.

We conduct our own in‑depth technical and commercial due diligence and then work with operators to accurately determine how much capital is needed and how it should best be utilised.

While we have invested in projects all over the world, our current mandates focus on investments in the US only.

Upstream Oil & Gas Investment Manager

Managing discretionary pools of capital on behalf of insitutional and higher net worth private investors.

Delivering current yield and capital gains from portfolio of investments in Minerals/Royalties and direct asset level interests in partnership with best in class operating companies.

Smaller fund size allows investment in individual, independent projects that offer fantastic growth opportunities

Direct level ownership in both minerals and development projects

Working in partnership with operators as opposed to funding corporate entities. With local staff, insight and knowledge

Superior data analytics from proprietary in‑house knowledge